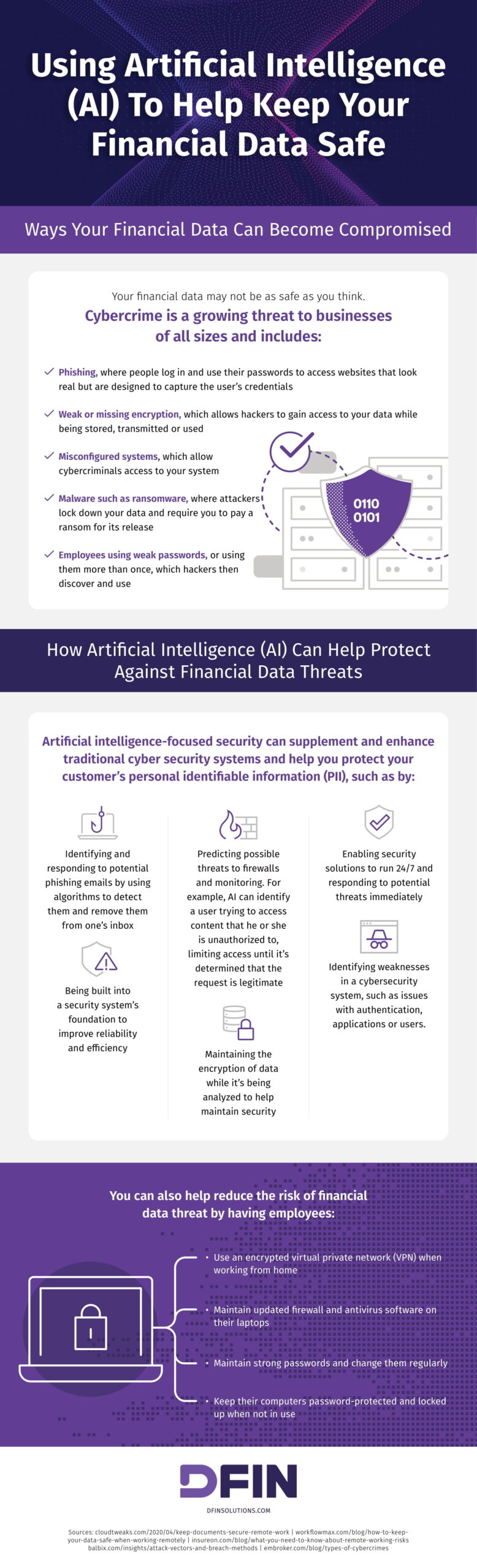

Every day, it seems like there is a new report that a major business has been hacked. In some cases, it’s a data breach. In others, a company’s financial data is held ransom. No business is too large or too small to worry about the security of its financial data.

Read on to explore common ways that a company’s financial data is compromised and how the latest cybersecurity tools can protect your small business’s or startup’s data with the help of AI.

How Hackers Target Financial Data

Hackers target financial data using numerous methods. The most common of these include:

- Phishing emails: In a phishing email, hackers try to gain a user’s legitimate access credentials (username and password) through emails that mimic something legitimate, such as a company with which the user has an account.

- Weak or missing encryption: Encryption protects data during transit by encoding it. When encryption is weak or missing, it cannot protect data. Hackers can use anything they gain access to in this case.

- System misconfigurations: When the system is misconfigured, hackers can steal financial data by identifying and exploiting loopholes caused by the misconfiguration.

- Malware: Malware or malicious software is a common way that hackers gain access to legitimate credentials. In this case, malicious code is bundled inside something that a user downloads, such as a new piece of software or an app.

- User error: User error covers a range of poor practices that employees can adopt. The most common of these is weak passwords, such as “password” or “123456.” Recycling passwords across websites is another common error.

This backfires because a hacker can get a user’s controls in another data breach, then make them publicly available on the dark web. When the information is out there, it’s only a matter of time before your organization is targeted. User error can also include employees’ behavior in public places. If someone leaves a work phone or laptop in a coffee shop, it could be stolen or compromised.

There are important considerations for your business. When your financial data is compromised, it doesn’t just affect business operations. It exposes customer data to malicious actors. This can lead to a loss of reputation and trust, as consumers no longer believe your company is trustworthy. It can also come with financial consequences.

Companies must pay damages to consumers who were harmed, for instance by paying for identity theft protection services. By taking steps to demonstrate your concern for customer data, you can not only protect your business, you can protect your reputation.

How AI Protects Against Hackers

Knowing the threats is the first step to staying safe. The next step is to protect your financial data using the right cybersecurity system. Next-generation cybersecurity software uses AI to protect a business’s financial data by identifying and defending against threats.

AI makes use of machine learning and algorithms to “teach itself” what type of activity is suspicious. The software adapts, just like hackers’ techniques continue to evolve. AI can run 24/7, providing network protection when your in-house technology team is asleep.

Not only does the AI monitor incoming emails for suspicious links, but it also protects firewalls so that anyone who penetrates the network perimeter cannot access sensitive financial data. AI looks at requests for traffic, then checks the credentials of the authority to make sure that the person has the right to view or access that content.

A mismatch could indicate that a hacker with someone’s legitimate credentials is trying to gain access to financial data. If the request is deemed legitimate, the user is allowed access. If the request is not legitimate, the software will not allow access. By understanding how AI-powered software protects business data, you can install the right software.

For further information on this topic, be sure to consult the accompanying resource. Infographic created by Donnelley Financial Solutions.